said Sara Collins, a vice president at the Commonwealth Fund, a health research group.“We’re at a point where there’s been slow growth in health care costs and huge improvements in the numbers of people who have health insurance,”

Among those who reported having problems paying their bills despite having insurance, 63 percent said they used up all or most of their savings; 42 percent took on an extra job or more work hours; 14 percent moved or took in roommates; and 11 percent turned to charity. Unlike other polls, which have focused on the ways that insurance affects health care, the new Times-Kaiser survey explored the effects of medical bills on people’s daily lives well beyond the medical system. It found that medical bills don’t just keep people from filling prescriptions and scheduling doctors’ visits. They can also prompt deep financial and personal sacrifices, affecting their housing, employment, credit and daily lives. Kaiser has released a report today, detailing the survey’s main findings about this population.“But there is this underlying trend towards higher cost sharing that could put increasing numbers of people at risk for being underinsured.”

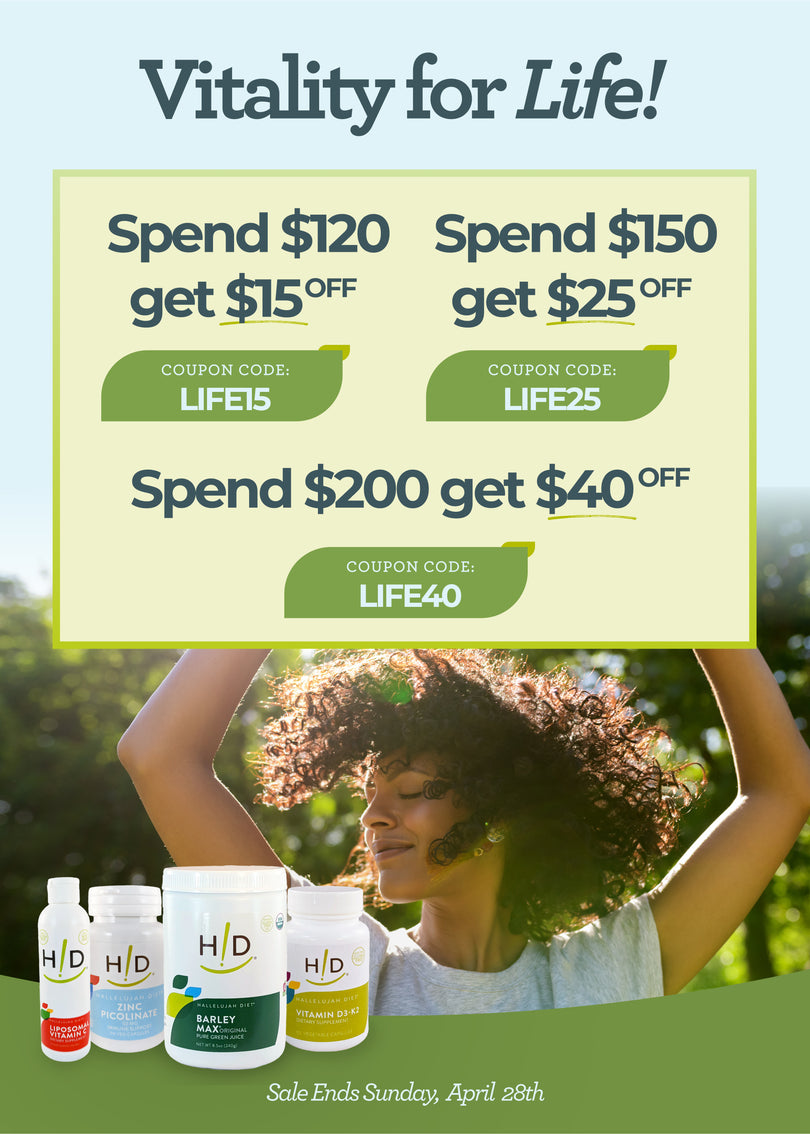

said Drew Altman, president of the Kaiser Family Foundation. Of the people in the survey reporting difficulty with their medical bills, 34 percent lacked health insurance, 39 percent had insurance through work, 14 percent were covered through public programs and 7 percent had purchased their own health plans. In the study there were examples of people giving up their homes, allowing strangers to move in for extra income and reducing amounts of meds just to pay for their medical bills. Ten years ago, David Dranove, a professor of health management at Northwestern’s Kellogg School of Management, conducted research on people experiencing medical bankruptcies. The study he co-authored found that bankruptcy was largely a problem of the uninsured. “But with more people buying less generous health insurance, I think the old evidence might no longer be relevant,” he said. Insured people with financial problems often have plans with higher deductibles. But many said that the co-payments piled up to make their care unaffordable. Many also received big bills that were not covered by their insurance. Among the 32 percent of insured patients stuck with an out-of-network bill, more than than two-thirds of patients said they didn’t know the provider wasn’t covered. More than 25 percent of the insured respondents said a medical claim had been denied. Apparently this doesn’t seem to be impacting only the lower income people. The survey found that whether you are earning under $25,000 or over $100,000 medical bills can have a profoundly damaging effect. While most of us already know that nothing good comes free, it seems that our country is finding that out also. As great as it sounds to have more people with health insurance, it certainly hasn’t helped make America less sick and it obviously has already taken a major toll on America’s pocketbooks. As we have read through this article and the contents of the study, we find that a problem being addressed is that people are considered “underinsured.” We can’t even imagine the costs associated with being “properly” insured. As you begin your year and reflect on your goals whether they are financial or health goals, remember that in this day and age the two are definitely related. You cannot have financial health and stability with poor physical health. As this trend in sharing the health expenses of other Americans continues, it is important to share the message of the Hallelujah Diet, the self-healing body and the importance of knowing that the responsibility of American’s health rests solely on…Americans. The author of the NYT article couldn’t have said it better:“The major impact is actually a pocketbook or economic impact: their ability to pay the rent or the mortgage or buy food,”

“The surest way to enjoy the peace of mind that comes with having health insurance: Don’t get sick.”